Protecting the Love That Lasts a Lifetime

Life’s unpredictable. My Life Financial is here to offer a range of tailored life insurance and living benefit solutions. Together, let’s protect what matters most to you.

Our Promise

My Life Financial: Weaving a Safety Net of Love

Imagine a world where your absence wouldn’t be a financial burden on the ones you love. Imagine a legacy of security, a whisper of “I love you” carried on the breeze even when you’re gone. At My Life Financial, that’s the safety net we help you weave – a net woven from love, foresight, and a deep understanding of your life’s tapestry.

We know life can be beautiful, messy, and unpredictable. It’s filled with laughter shared over kitchen tables, dreams whispered under starry skies, and the quiet moments that make a life a treasure. But amidst the joy, there’s also a whisper of worry – a question of “what if?” What if something happened to you?

My Life Financial exists to quiet that worry. We believe in the power of life insurance and living benefits to transform that “what if?” into a gentle “we’ll be okay.” Because true security isn’t just financial; it’s the peace of mind that comes from knowing your loved ones will be embraced by love, even when you can’t hold them close. We’ll work closely with you to find the perfect coverage that fits your needs and budget, ensuring your loved ones are protected anytime anywhere.

Let us walk with you on this journey. Let’s weave a safety net of love and protect what matters, together.

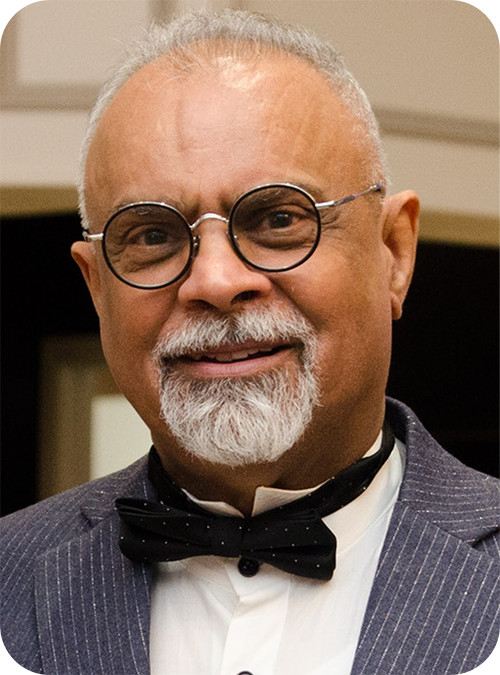

Mark Cadman

President, My Life Financial

Connect with Us

Phone

Who we are

Rick Jaitley

CEO

Lena Koh

Life Case Management

Our Mission

Empowering Your Peace of Mind

We understand that navigating life insurance and living benefits can be overwhelming. That’s why our mission is to bring clarity and peace of mind to you and your loved ones. We believe everyone deserves the security that comes with proper financial planning.

Our core values are integrity, transparency, and client focus. This means we hold ourselves to the highest ethical standards, provide clear and honest information, and prioritize your needs every step of the way. With personalized guidance and innovative solutions, we empower individuals, families, and employers with comprehensive life, disability, and group benefit plans.

Our team of experienced insurance professionals, with decades of combined experience, has helped countless families secure their future. We understand your needs and will work closely with you to find the perfect coverage that fits your budget, guaranteeing your loved ones are protected no matter what life throws their way.

With My Life Financial, you can transform that “what if?” into a confident “we’ll be okay.” Because true security isn’t just financial; it’s the knowledge that your love will continue to embrace them, even when you’re not around.

We promise. Every step of the way, we will be here for you. Get a free quote today and start building your peace of mind.

Products Offered

Life Insurance

Term life insurance provides coverage for a specific period, typically 5 to 30 years. If the insured dies during the term, the insurance company pays a death benefit to the beneficiaries.

Benefits:

- Fixed premiums

- Guaranteed death benefit

- Affordable

- Renewable

Whole life insurance is a type of permanent life insurance offering lifetime coverage as long as premiums are paid. It provides a death benefit to beneficiaries and includes a cash value component that grows over time.

Benefits:

- Lifetime coverage

- Fixed premiums

- Savings with cash value growth

- Guaranteed death benefit

- Dividends – share in carriers’ success

Universal life insurance is a type of permanent life insurance that offers flexible premium payments and death benefits. It combines a savings component (cash value) with a death benefit, ensuring lifetime coverage as long as premiums are paid.

Benefits:

- Flexible premiums

- Cash value savings

- Guaranteed death benefit

Children life insurance is a type of permanent life insurance and can be purchased for a child as soon as they are born.

Benefits

- Generally paid-up in 20 years

- Lifetime coverage

- Fixed premiums

- Cash value savings

- Guaranteed death benefit

- Option to increase coverage

Mortgage protection insurance is a specialized type of life insurance designed to pay off the outstanding mortgage balance if the policyholder passes away. Unlike typical life insurance plans, this coverage specifically targets mortgage debt, with the payout going directly to the bank or lender.

Benefits:

- Pays off outstanding mortgage balance

- Ensures your family can keep the home

- Affordable premiums compared to traditional life insurance policies

Final Expense Insurance, also known as last expense or funeral insurance, is a whole-life policy designed to cover funeral, burial, and other end-of-life expenses. Unlike typical life insurance plans, it focuses on easing the financial burden on your family during a difficult time.

Benefits:

- Covers funeral, burial, and cemetery costs

- Coverage from $25,000 to $100,000

- Affordable premiums

- Paid directly to the beneficiary

- Can be purchased anytime

- Combines with other life policies

Specialized and tailored insurance solutions for individuals with underlying medical conditions.

Benefits:

- Guaranteed death benefit

- Guaranteed premiums

- Flexible terms

Living Benefits

(Injury + Illness)

Critical illness insurance provides a lump-sum cash benefit if diagnosed with a covered medical condition, such as a heart attack, cancer, stroke or ALS. *Please review the policy for complete details.

Benefits:

- Lump-sum cash for treatments

- Funds for excluded health plan coverage or experimental therapies

- Income replacement

- Financial support for PSWs

Long-term care insurance covers a range of services and support for individuals needing assistance with daily living activities or who have cognitive impairments due to aging or chronic illness. These non-medical services ensure quality of life and independence and can be provided at home, in assisted living facilities, or nursing homes.

Benefits:

- Funds for quality care beyond government-funded services

Individual health insurance offers personalized medical coverage for individuals and their families, when employer-provided coverage is unavailable.

Benefits:

- Relieves financial burden of large medical bills

- Coverage for doctor visits, hospital stays, prescription medications, dental, chiropractic care, naturopathic services, and more

Disability insurance provides financial protection if you become unable to work due to a disability or illness. It typically replaces a portion of your income during your period of disability, helping you meet your ongoing expenses.

Benefits:

- Income replacement for mortgage/rent payments

- Coverage for groceries and daily living expenses

- Financial security during recovery

Travel insurance provides coverage for unexpected events while travelling out of the country or out of the province, ensuring you receive financial and medical protection against trip disruptions. Travel insurance is available on a per-trip basis or as an annual option.

Benefits:

• Medical emergency coverage

• Trip cancellation protection

• Compensation for lost luggage

Group /Employer

Benefits

Group life insurance provides life insurance coverage for a group of people, typically employees of a company or members of an organization.

Benefits:

- Employer-provided coverage at no or low cost to employees

- Typically coverage is approximately 1 to 2 times an individual’s annual income

Group health benefits provide comprehensive healthcare coverage to employees and families of a company or members of an organization.

Benefits:

- Coverage for doctor visits, hospital stays, prescription medications, dental, chiropractic care, naturopathic services, and more

- Employer-provided coverage at no or low cost to employees

Group dental insurance provides comprehensive dental coverage to employees or members of an organization to maintain oral health.

Benefits:

- Coverage for routine cleanings and exams

- Basic procedures like fillings and extractions

- Major services such as crowns and root canals

Group disability insurance is offered as part of an employee health coverage plan for employees unable to work due to disability or illness.

Benefits:

- Income replacement during disability

- Coverage for groceries and daily living expenses

- Financial security during recovery

Combination

Insurance

Combination insurance packages life, disability, and critical illness coverage into one comprehensive plan. This is not a typical life insurance plan, as it provides a multi-faceted approach to financial protection, covering various life events and health issues.

Benefits:

- Comprehensive coverage in one plan

- Simplified management of multiple needs

- Reduced premiums with group coverage

Life insurance is a financial product that provides a lump-sum payment (death benefit) to your loved ones upon your death. It helps protect your family financially by replacing your income and covering expenses such as funeral costs, mortgage payments, and debts.

Life insurance provides financial protection for your loved ones in the event of your death. It can help cover living expenses, outstanding debts, and future financial goals, ensuring that your family can maintain their standard of living and achieve their dreams even after you’re gone.

The amount of life insurance coverage you need depends on factors such as your income, debts, lifestyle, and financial goals. A general rule of thumb is to aim for coverage equal to 5 to 10 times your annual income, but it’s essential to assess your specific needs and consult with a financial advisor for personalized guidance.

There are two primary types of life insurance: term life insurance and permanent life insurance. Term life insurance provides coverage for a specified period (term), while permanent life insurance offers lifelong protection and includes a cash value component that can accumulate over time.

When you purchase a life insurance policy, you pay regular premiums to the insurance company. In return, the insurance company agrees to pay a death benefit to your beneficiaries upon your death. Your beneficiaries can use the death benefit to cover expenses and financial obligations after you’re gone.

The cost of life insurance depends on factors such as your age, health, coverage amount, and type of policy. Term life insurance is typically more affordable than permanent life insurance, making it a popular choice for individuals seeking cost-effective coverage.

Some life insurance policies require a medical exam as part of the underwriting process to assess your health and determine your premium rates. However, there are also options available for no-exam life insurance, which may be suitable for individuals who prefer to skip the medical exam.

Yes, you can make changes to your life insurance policy, such as adjusting coverage amounts, updating beneficiaries, or adding riders. It’s essential to review your policy regularly and make changes as needed to ensure that it continues to meet your evolving needs.

The best time to buy life insurance is when you’re young and healthy, as premiums tend to be lower. However, it’s never too late to get coverage, and the right time to buy life insurance is when you have financial dependents or obligations that you want to protect.

If you stop paying your life insurance premiums, your policy may lapse, and your coverage will end. Some policies may offer a grace period during which you can make late payments to keep your coverage active, but it’s essential to understand the consequences of missing payments and explore options for maintaining coverage.

Getting life insurance when you’re young offers:

- Lower Premiums: Younger age often means lower premiums.

- Financial Protection: Protects loved ones from financial burdens.

- Building Cash Value: Some policies accumulate cash over time.

- Future Insurability: Locks in coverage before health changes.

- Peace of Mind: Provides security for loved ones’ future.

Yes, it can still be beneficial:

- Financial Protection: Covers expenses and provides for loved ones.

- Estate Planning: Helps with taxes and leaving a legacy.

- Income Replacement: Replaces lost income for dependents.

- Peace of Mind: Ensures financial security for loved ones.

While children life insurance, also known as juvenile life insurance, may not always be essential, it offers several benefits:

- Insurability Lock: Secures coverage early, regardless of future health issues.

- Cash Value Growth: Accumulates cash value over time for future expenses.

- Financial Protection: Covers funeral expenses and provides a death benefit.

- Paid-Up Policy Option: Offers lifelong coverage without further payments after a set period.

The amount paid by the policyholder to the insurance company in exchange for coverage.

The contract between the policyholder and the insurance company outlining the terms and conditions of coverage.

The person or entity designated to receive the benefits of a life insurance policy upon the insured’s death.The person or entity designated to receive the benefits of a life insurance policy upon the insured’s death.

The sum of money paid out to the beneficiary upon the death of the insured.

The initial amount of coverage specified in a life insurance policy.

The accumulated savings component of certain types of life insurance policies that can be accessed by the policyholder.

Life insurance coverage for a specified period (term) of time, typically ranging from 10 to 30 years.

Permanent life insurance coverage that provides lifetime protection and accumulates cash value over time.

Flexible permanent life insurance that allows the policyholder to adjust premium payments and death benefits.

Permanent life insurance with a cash value component that can be invested in various investment options.

Insurance that pays off a mortgage in the event of the borrower’s death, ensuring that the remaining mortgage balance is covered.

Insurance that provides a lump-sum payment upon the diagnosis of a covered critical illness, such as cancer, heart attack, stroke or ALS.

*Please review the policy for complete details..

An option in certain permanent life insurance policies where premiums are paid for a set period, and then the policy becomes fully paid-up, meaning no further premiums are required, but coverage continues for life.

An additional provision added to a life insurance policy to modify or enhance coverage.

The process of assessing an applicant’s risk factors to determine their insurability and premium rates.

The likelihood of an applicant being accepted for insurance coverage based on their health, lifestyle, and other risk factors.

The period of time after a missed premium payment during which coverage remains in force.

The termination of a life insurance policy due to non-payment of premiums.

The amount of cash value available to the policyholder upon surrendering a permanent life insurance policy.

Options available to policyholders when a permanent life insurance policy is surrendered, such as cash surrender value, reduced paid-up insurance, or extended term insurance.

The secondary beneficiary designated to receive the death benefit if the primary beneficiary predeceases the insured.

Specific events or conditions that are not covered under a life insurance policy.

A provision that allows the policyholder to receive a portion of the death benefit in advance if diagnosed with a terminal illness.

The timeframe during which the insurance company can investigate and contest the validity of a life insurance claim.

The option to convert a term life insurance policy into a permanent life insurance policy without undergoing a medical exam.

A loan taken out against the cash value of a permanent life insurance policy.

A provision in a life insurance policy stating that after a certain period (typically two years), the insurance company cannot contest the validity of the policy based on misrepresentation or concealment by the insured.

My Life Financial insurance products are underwritten and distributed by My Insurance Broker Corp., 50 West Wilmot Street, Unit #6, Richmond Hill, ON L4B 1M5. Product information is for descriptive purposes only and does not provide a complete summary of coverage. You may wish to speak with a licensed life insurance broker for advice about your insurance needs. Individual circumstances may vary. My Life Financial insurance products are available in Canada. Use of this site constitutes acceptance of our Terms of Service and Privacy Policy. The material on this site may not be reproduced, distributed, transmitted, cached or otherwise used, except with the prior written permission of My Insurance Broker.

My Life Financial is a trade name registered by My Insurance Broker Corp. ©2024 My Insurance Broker. All Rights Reserved.